Water for Women is the Australian Government’s flagship Water, Sanitation, and Hygiene (WASH) program and is being delivered as part of Australia's aid program. It is supporting improved health, gender equality and wellbeing in Asian and Pacific communities through socially inclusive and sustainable WASH projects. www.waterforwomenfund.org

RTI India is exploring the potential of blended financial structures for increased private-sector participation towards WASH initiatives. WASH programs in India are faced with the challenge of limited private funding. In our first blog, we attempted to unearth reasons for limited private sector financing, specifically in WASH infrastructure, and whether or not introducing blended finance may improve this outlook. In the second blog, we listed prevailing options in India for blended financing in WASH infrastructure projects and how these can be scaled up.

The last in our three-part series aims to assess reasons for limited blended finance in WASH programs, list prevailing examples for blended financing, and how these could be scaled up. In this blog we will provide examples of successful innovative blended finance deployments.

Context for Discussion

What is blended finance in the context of WASH?

Blended Finance often uses philanthropic funding to mobilize private investments, through a variety of financial instruments and mechanisms. Each dollar of concessional capital deployed, on an average, mobilizes AU$4 of commercially priced capital. At this pace, the Indian WASH ecosystem will require AU$3.5 billion of concessional finance annually.

Philanthropic capital in India increased by 23% to approximately AU$12.5 billion in 2020.This stemmed from four sources: foreign (24%), domestic corporate (28%), domestic high net-worth individuals/ families (20%), and other retail investors (28%). Despite the availability of significant philanthropic capital, there are only a few instances of it being deployed for blended finance facilities for sustainable development, including WASH. There are two potential reasons for this:

- WASH is not a focus/ favored sector for philanthropic action in India.

- Market barriers prevent philanthropy being used for creating blended finance options.

Insights from the Consultation

Philanthropic capital flow in WASH is limited: In FY 2019-20, WASH represented just 3% of total domestic corporate philanthropy. Amongst high net-worth individual and family contributions, WASH is a subset of ‘others’ category which cumulatively adds up to just 6%. Empirical extrapolation of these results suggests that annual domestic philanthropic contribution to WASH is barely AU$0.3 billion compared to the annual concessional finance demand of AU$3.5 billion (<10%).

Awareness of blended finance concept is limited: There are a handful of cases where blended finance has been successfully implemented in India. While small- and medium-sized donors remain conceptually unaware of blended finance facilities, a lack of detailed research on these case studies deters larger donors from exploring them. Thus, they usually prefer to adopt traditional grant-making approaches with low risk and visible impact.

Regulatory constraints exist: Philanthropic capital flows in India is governed by two regulations: the Companies Corporate Social Responsibility Rules (CSR), which govern domestic CSR flows, and the Foreign Contribution Regulation Act (FCRA), which regulates receipt of foreign contributions or aid from outside India to Indian territories. Certain provisions in both these regulations affect donors’ ability to engage in blended finance facilities:

- Rule 4(5) of the CSR Rules require CSR funds to be disbursed and utilized for a pre-determined purpose. Blended finance mechanisms, like revolving funds, are never fully and irreversibly expended and cannot be substantiated as ‘utilized’ through fund utilization certificates.

- Section 7 of the FCRA prohibits sub-granting foreign donations. Restrictions on sub-granting limit participation in blended finance facilities, which often involve several collaborating agencies.

Examples of Innovative Blended Finance Structures in WASH and Beyond

Despite these limitations, certain programs, of the WASH sector and beyond, have still been able to pursue blended finance structures due to innovation in the business model adopted. This suggests that these structures have been able to overcome the regulatory barriers. In the following examples, philanthropic capital is non-refundable and completely utilized. Hence, if the source of this philanthropic capital is CSR funds, such spends are eligible to receive the fund utilization certificate.

One-time Non-returnable Grants (Concessional Finance) for Prompting Equity Investments (Commercial Finance)

Context: Under the Water for Women Fund initiative, RTI International fosters partnerships between WASH-based private sector, non-government organizations (NGOs), and prospective entrepreneurs, from marginalized groups, identified by these NGOs. The partnerships facilitate increased access of WASH products/ services, offered by the private sector in the marginalised communities. The entrepreneurs act as a WASH awareness and product/ service sales medium, earning a margin against sales. The NGO trains and coordinates efforts among several identified entrepreneurs.

Need for Concessional Finance/ Additionality: Ordinarily, any business venture requires upfront equity investment from the entrepreneur. However, in this case, the entrepreneurs hail from economically weak and marginalized backgrounds and are not financially able to make upfront equity investments.

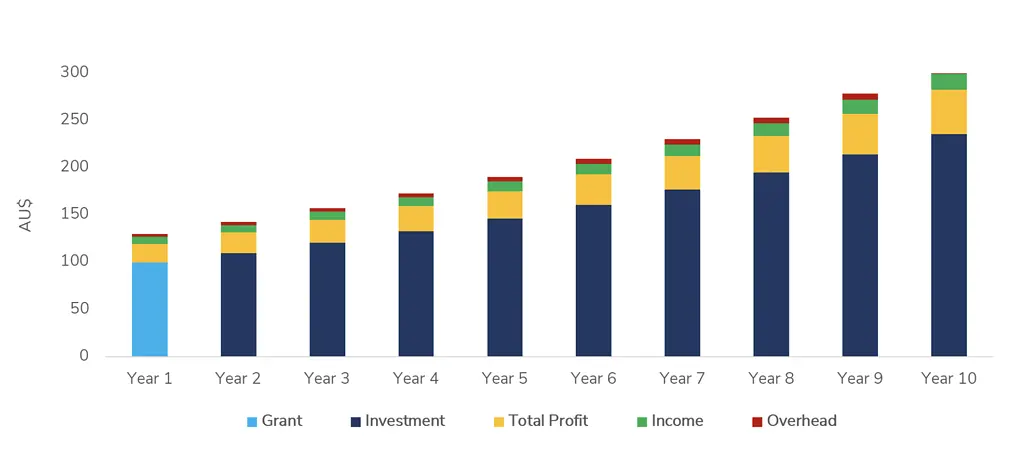

Deployment Mechanism of Concessional Finance: CSR funds (say, AU$100) is extended as a one-time, non-returnable grant to NGOs. The NGOs use the grants to procure the first batch of WASH products on behalf of the entrepreneurs. The entrepreneurs sell these products along with a premium (say, 20%). From the 2nd cycle onwards, the NGO retains just a supervisory role while the entrepreneur invests most of the earned funds (say, AU$110 out of AU$120) to purchase the next batch of products. These are again sold at a premium so that the entrepreneurs’ total fund corpus swells and the cycle repeats.

Concessional Finance Prompting Equity Investments: The initial grant (of value AU$100), is prompting ever-increasing equity investment in the WASH business model. Consequently, the leverage achieved by the concessional finance is also continuously increasing in every cycle.

Example of Deployment: In Rajasthan (India), RTI deployed this model wherein it partnered with a local NGO, CECOEDECON. CECOEDECON utilized one-time CSR contribution/ grant from Great Eastern, a private sector entity, to help women from marginalized communities to purchase menstrual hygiene products. These women entrepreneurs sold these products at a premium and reinvested earning for subsequent larger product. Consequently, sales volumes using the mechanism described above.

Outcome-based Aid (Concessional Finance) for Prompting Impact Investments (Commercial Finance)

What is outcome-based aid?

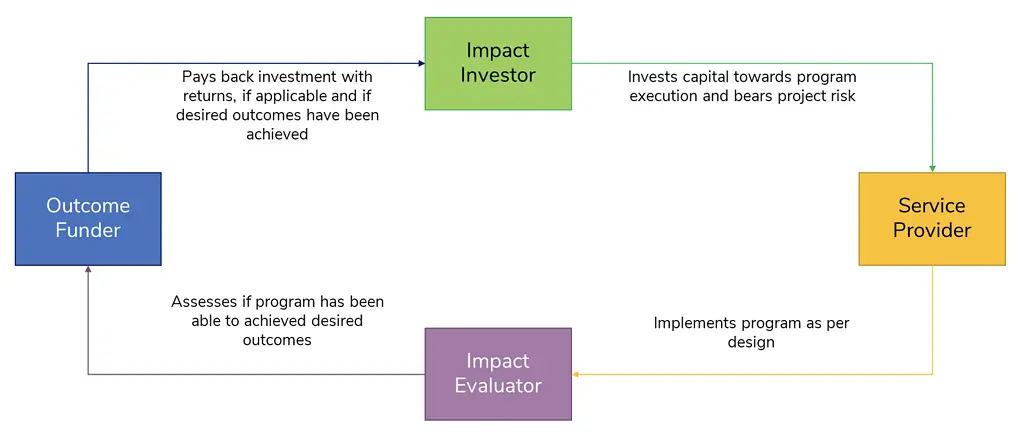

Outcome-based aid refers to conditional release of funds, from philanthropic sources, for repaying investors along with pre-determined returns. Usually, the condition precedent is around achievement of minimum or desired project outcomes.

Context: Impact investors are willing to provide upfront capital for programs which create social/ developmental impact as well as provide financial returns.

Need for Concessional Finance/Additionality: Most developmental programs do not have a defined revenue stream and hence, are unable to offer financial returns to impact investors.

Deployment Mechanism of Concessional Finance: Philanthropic sources, who have a similar developmental vision as the impact investor(s), assure desired financial returns to the impact investor upon achievement of developmental targets. The risk of non-achievement lies, however, with the impact investor. Achievement of targets is validated by an external evaluating agency.

Concessional Finance Prompting Impact Investments: Introduction of a well-defined revenue and returns improves eligibility of prospective projects for requesting impact investments.

Example of Deployment: For the Quality India Education Program, UBS Optima Foundation extended AU$ 4 million as impact investment at 8% returns. Based on independent evaluation by Gray Matters India, Michael and Susan Dell Foundation (MSDF) and consortium of funders convened by the British Asian Trust (Tata Trusts, Comic Relief, Mittal Foundation, British Telecom) are acting as Outcome Funders.

Performance Guarantees

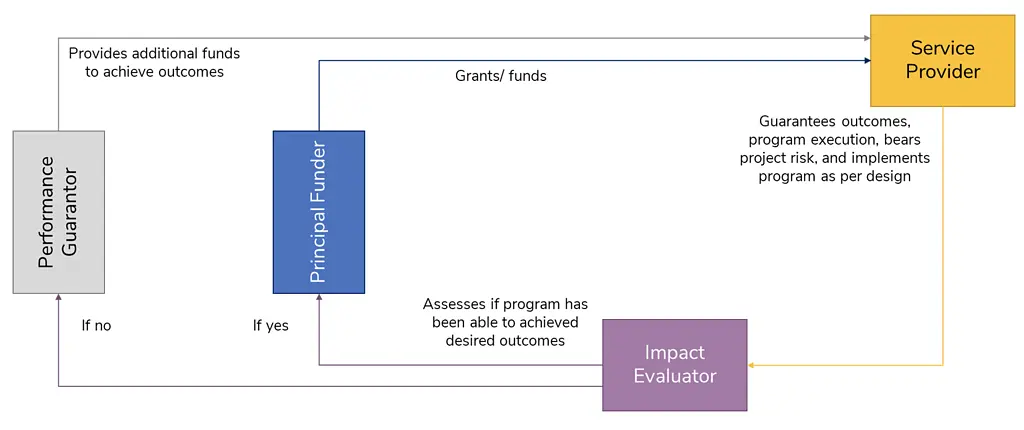

Context: Most developmental programs possess varying degree of risks. The likelihood of occurrence of these risks and non-achievement of outcomes are challenging to anticipate. This may deter funders from participating, especially in extremely ambitious/ risky developmental programs.

Deployment Mechanism of Concessional Finance: Two elements of philanthropic support are involved: the Principal Funder and a second philanthropic capital provider, which extends a certain performance guarantee in the event of non-achievement of developmental outcomes using primary funds from Principal Funder.

Example of Deployment: For the Haryana Early Literacy Program, IndusInd Bank and SBI Foundation extended ~ AU$ 3 million to the Language and Learning Foundation against pre-defined outcomes. Based on independent evaluation by Educational Initiatives around actual performance achievement, Central Square Foundation agreed to extend a performance guarantee up to 20%.

Resolving Other Challenges to Scaling Innovative Blended Finance Structures in WASH Sector in India

These examples demonstrate that options exist to invest philanthropic capital toward blended financing structures. While staying within regulatory constraints, these examples create awareness on such structures and their impacts, even amongst large foundations, which may inspire these agencies to pursue investments.

Limitations in philanthropic capital flow in WASH could be overcome by designing WASH programs to bring in convergence with ‘philanthropy magnets’ like Education, Health, and Rural Development sectors. Examples include WASH in schools, WASH in healthcare institutions, WASH-based livelihoods, etc.

Learn more about RTI's water resources and urban sanitation initiatives.

Authors

Shikha Srivastava, Head – Urban Poverty Alleviation, Tata Trusts

Urmi Sengupta, Senior Program Officer, Impact Investments, MacArthur Foundation

Sakshi Gudwani, Senior Program Officer, Bill and Melinda Gates Foundation

Roshan Negi, Lead – CSR, SBI Capital Markets

Vijayata Verma, Investments (Resilient Livelihoods), EdelGive Foundation

Aiswarya Ananthapadmanabhan, Partnerships, EdelGive Foundation

Views expressed by the experts are personal and do not necessarily reflect the official policy or position of the organization they represent.