Water for Women is the Australian Government’s flagship Water, Sanitation, and Hygiene (WASH) program and is being delivered as part of Australia's aid program. It is supporting improved health, gender equality and wellbeing in Asian and Pacific communities through socially inclusive and sustainable WASH projects. www.waterforwomenfund.org

The Need for WASH Infrastructure Private Sector Support in India

As noted in our first blog, RTI India seeks to increase private sector participation in WASH. Limited private-sector financing with a lack of adequate public funding from the government leaves WASH programs susceptible to failure and creates unrealistic expectations from project design. In our first blog we provide potential solutions to enhance private sector investment in WASH programs and close the financial gap between program design, budget, and government and private sector partners.

In this second blog of a three-part series, we will discuss financial options for WASH infrastructure in India. This blog aims to explain India’s complex financial opportunities and lay out the best options for a financial increase in WASH.

Loss Guarantee Options for Increased WASH Investment

What is a Loss Guarantee?

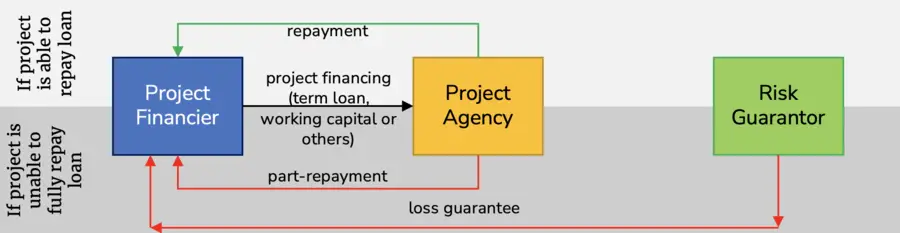

A Loss Guarantee is a loss sharing facility in which a guarantor of funds, in the event of project loss, reimburses a pre-determined portion of the repayment due to the financier. Such guarantees are additional because they provide significant coverage to the financiers’ risk and enhances a project’s ability to secure/raise finance. A simplistic version of the conceptual framework is depicted through the diagram below:

Partnering to Expand Private-Sector WASH Funding

There are several loss guarantee options available in the Indian WaSH ecosystem catering to lending amounts ranging from AU$ 1 million – 5+ million. These have been described below:

Svakarma Finance is an impact focused Non-Banking Financial Company (NBFC) that follows the principle of purpose-based lending while lending to micro, small and medium enterprises, usually owned by economically weak and marginalised entrepreneurs. It offers working capital loans up to 3 years tenure and asset finance loans up to a tenure of 4 years to cover cashflow mismatches/purchase of asset, at a lending rate of 15-30%. USAID has extended an AU$1.35 million losses guarantee to Svakarma to be extended to WASH entrepreneurs.

Caspian Debt is another NBFC which uses debt as a means of impact investing focusing on entrepreneurs who cannot access finance from banks. Caspian has access to guarantee facilities from Rabo Foundation, Rabo Rural Fund, and USAID, to the tune of AU$13.5 million towards term loans, working capital loans, bridge loans and subordinated loans with ticket sizes of AU$ 0.1–3 million, tenures of 0.5-5 years, and at an interest rate of 16-18% for the enterprises. Caspian has already extended AU$860k as loans to enterprises which are covered under the USAID credit guarantee scheme.

IndusInd Bank is one of the larger private sector banks of India. It offers term loans, working capital, project financing, transaction banking, etc. to corporate customers, at tenures ranging from 8-10 years at competitive interest rates. USAID has signed for an AU$67 million in loss guarantee to promote the development of liquid waste management projects in India.

Addressing Public-Private Financial Risk in WASH with the Hybrid Annuity Model

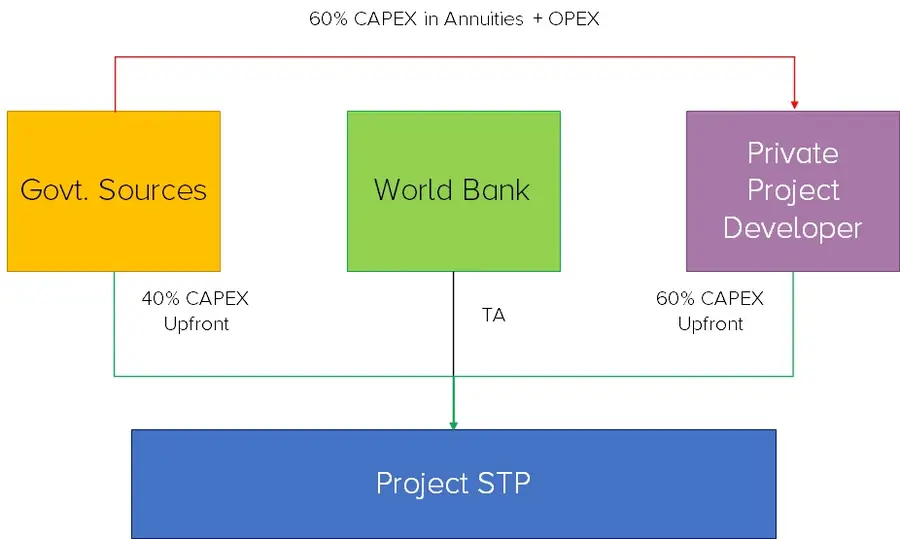

The Hybrid Annuity Model (HAM) has been recently introduced in the WASH sector to balance public-private risks in infrastructure development. Adopted in the World Bank-supported Namami Gange program, which aims to prevent disposal of untreated sewage and arrest pollution in River Ganga, the government will contribute to 40% of the project cost. The balance 60% will be paid, to the private sector, over the life of the project as annuities along with operation and maintenance cost expenses.

This financing model gives liquidity to the developer and the financial risk is shared by the government. In other words, the HAM model is additional as the government contribution provides adequate confidence to the private sector to invest the remaining capital investment. This model also ensures sustained performance of the assets created due to better accountability, and ownership by private sector partners.

Viability Gap Funding for WASH Allows One-Time Grants

Viability Gap Funding (VGF) usually refers to a grant, one-time or deferred, provided to support infrastructure projects that are economically justified but fall short of financial viability. Additionality of VGF exists, as such grants enhances project viability to an extent where it can attract commercial finance.

For example, some of the principal development goals expected of the AU$93 million Chandigarh 24/7 water supply project are:

- Improved women’s lifestyle and health due to greater household water availability.

- Improved water availability to economically weaker section.

- Overall improvement in water-use efficiency and its impact on climate resilience.

However, given that cost recovery from economically weaker sections of the society would be challenging, the European Union agreed to extend a grant valued to ~17% of the project cost. The balance funds are planned to be raised from Agence Française de Développement/ AFD (72%), as loans, and internal government sources (11%). The project is currently awaiting sign-off from the Government of India.

Suggested Options for Scaling Up Blended Finance in India’s WASH Sector

- Even projects financed through blended funds, some of which have been described above, require dependable cost recovery options. Identifying such options, or enhancing dependability of these cost recovery options, can help existing blended finance facilities to be extended to a greater number of projects.

- While strong project bankability assessment frameworks exist, there is an opportunity to significantly strengthen the capacity of financial institutions in aspects of market limitations and opportunities and blended finance options.

- Philanthropic capital in India, valued more than AU$10 billion annually and utilized majorly for WASH programs, could be leveraged to set up concessional finance structures toward WASH infrastructure development.

Learn more about RTI's water resources and urban sanitation initiatives.

Authors

Dr. Joseph Ravikumar, Sr. Water and Sanitation Expert

Diane Jegam, Regional Head, South Asia Proparco Groupe AFD

Ankit Tulsyan, Sector Portfolio Manager – WASH, AFD

Nishu Malhotra, Head, Healthcare and Impact Investing, Induslnd Bank

Priyanka Johnson, Programs and Partnerships Manager, Induslnd Bank

Meenal Jai Singh, Head – Partnerships, Svakarma Finance

Sai Pramodh, Sr. Investment Manager, Caspian Debt

Views expressed by the experts are personal and do not necessarily reflect the official policy or position of the organization they represent.