When most people hear the word packaging, they think of boxes and shipping. In semiconductors, advanced packaging means something far more consequential. It refers to the technologies that determine how chips are integrated, connected, tested, and ultimately made usable in real-world systems. The need to “unpack” advanced packaging for broader audiences is a reminder that even as semiconductor investments grow, what is being built and why is not always well-understood.

Competition in the semiconductor industry is not only about producing more chips at scale. It is also about enabling specialized, high-performance technologies that power defense systems, aerospace, medical devices, and other critical applications. These capabilities sit at the intersection of research, manufacturing, workforce, and regional infrastructure, with each region bringing a distinct combination of strengths and constraints.

This is where regional evidence and analysis become essential. Understanding how different regions contribute to the national semiconductor ecosystem and how capabilities such as advanced and specialty packaging fit within it helps make sense of complex investments.

This post draws on the first 18 months of evaluation and strategic advising led by RTI International for the Florida Semiconductor Engine (FSE), one of the inaugural Regional Innovation Engines sponsored by the National Science Foundation (NSF), with a mission to “transform the U.S. semiconductor advanced and specialty packaging industry.” Florida is not presented as a stand-alone story, but as a case study that illuminates how regional systems respond to national semiconductor priorities.

Establishing Expectations: Baseline and Benchmark Analysis

As part of NSF’s expectations for Engines in their early years, evaluators were required to establish a clear understanding of its starting point, its assets, gaps, and position relative to other regions through relevant baseline and benchmarking analysis.

The purpose was to provide a shared, objective reference point that could help center conversations among diverse stakeholders and communicate FSE’s role to national policymakers and partners who may not be familiar with Florida’s semiconductor landscape. This was especially important because the speed with which development is taking place is rapid, and there is an enormous need to bring clarity about the key players and their strengths.

In addition, NSF views Engines not only as performers, but also as testbeds for new ways of doing regional development. That expectation creates both opportunity and pressure. NSF looks at the Engines as innovators for faster and better ways of advancing regional innovation, and that has created space to experiment, but also a need for strong feedback loops.

RTI’s role as independent evaluator and advisor reflects that reality. Evaluation in this context is not retrospective reporting; it supports real-time sense-making, helping leadership stay oriented while, as one often hears in this space, they are “trying to build an airplane while flying it.”

RTI’s approach and why Florida’s semiconductor ecosystem cannot be understood in isolation

The Florida Semiconductor Engine anchored in Central Florida, with its operational epicenter at NeoCity in Osceola County, but the analysis conducted as part of this work was intentionally performed at the state level. Semiconductor investments operate at a national scale, and state-level coordination, across education institutions, workforce systems, economic development, and infrastructure, is critical to competitiveness.

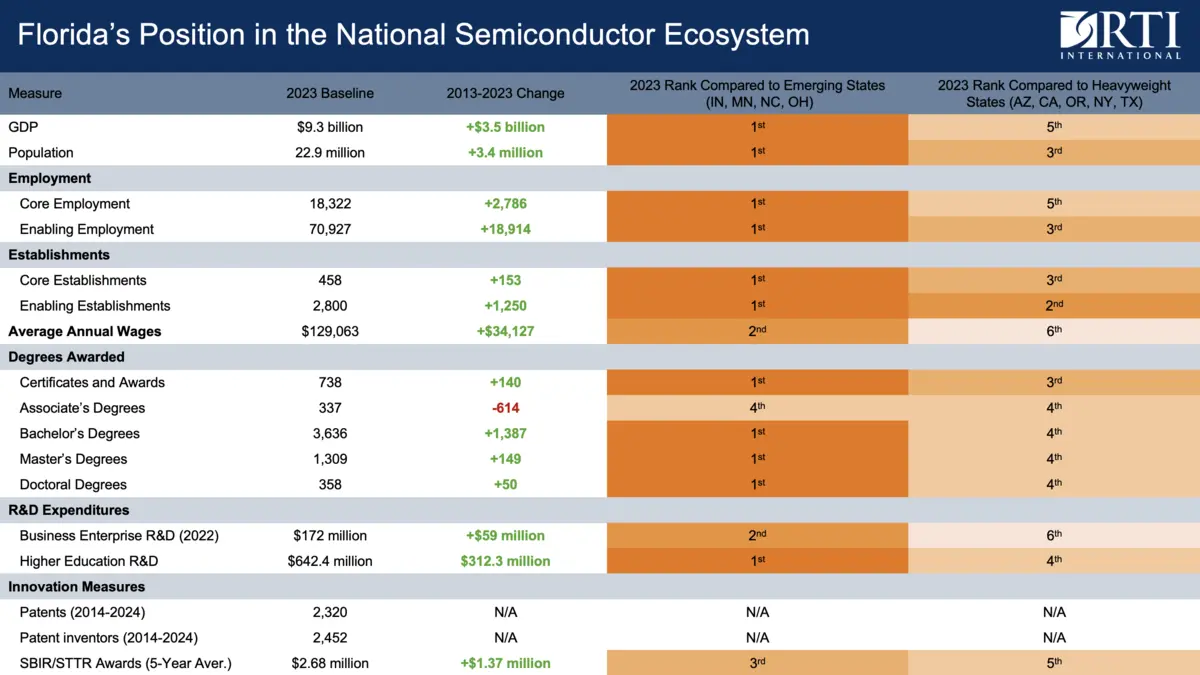

Florida could also not be examined in a vacuum. Understanding Florida’s role required comparison, both to states with long-established semiconductor dominance and to states that, like Florida, are building newer or more specialized ecosystems. The comparison looks at the comprehensive list of relevant indicators summarized below. The analysis supports interpretation, not rankings for their own sake, where the two comparison groups identified as:

- Heavyweight semiconductor states (Arizona, California, New York, Oregon, Texas), and

- Emerging semiconductor states (Ohio, Indiana, Minnesota, North Carolina).

This approach helps distinguish Florida’s role and explain why Florida is a plausible, and distinct, advanced and specialty packaging ecosystem, including:

- Strong demand pull from established aerospace and defense industry,

- Long-run employment stability in semiconductor-related industries during period of offshoring and economic crises,

- A large and stable base of small and mid-sized firms, and

- A K12 through higher education system producing growing numbers of bachelor’s and graduate-level degrees, alongside recognized gaps in technician pathways.

Florida’s middle of the pack position is consistent with many state stakeholders’ shared vision to diversity its economy and also represents one of the drivers behind the Engine’s overall strategy to continue refining its knowledge and pursuing opportunities in advanced and specialty packaging space.

To surface the most policy-relevant insights, the infographics below examine Florida through multiple dimensions to provide a comprehensive view of the state’s position within the national semiconductor ecosystem. The visuals begin by situating Florida on the U.S. map in terms of its contribution to semiconductor and related industry GDP, establishing its economic relevance at the national scale. They then turn to Florida-specific assets and geography, highlighting how the state’s spatial distribution of capabilities, infrastructure, and institutions shapes its role in the ecosystem.

The analysis further underscores Florida’s distinctive industry structure, characterized by a high number of establishments operating across semiconductor-adjacent activities, an indicator of diversity, adaptability, and potential for integration rather than concentration in a small number of dominant players. The visuals conclude with a longitudinal view of semiconductor-related employment, illustrating how Florida’s industry has weathered major economic downturns and periods of offshoring over the past several decades.

Taken together, these dimensions help explain the conditions that enabled the emergence of the Florida Semiconductor Engine and continue to inform its strategic focus. Rather than telling a single-metric story, the infographics reveal a combination of economic scale, industrial diversity, geographic positioning, and long-term resilience that distinguishes Florida within the broader national semiconductor landscape.

Note: For readers interested in the most complete inventory of Florida’s semiconductor assets, the Florida Semiconductor Institute maintains a web-based map that complements this analysis.

The presence of aerospace and defense industries is particularly consequential. These sectors represent important end users of advanced and specialty packaging technologies, providing early validation environments that can accelerate translation and commercialization, especially for dual-use technologies that serve both defense and commercial markets.

Because the Florida Semiconductor Engine engaged these partners early, its R&D portfolio already benefited from closer alignment with real-world performance requirements. In practice, this shortens feedback cycles between research, integration, and application, an increasingly important feature in a policy environment focused on speed and mission relevance.

Access within the notoriously exclusive semiconductor industry

Within the broader semiconductor universe, the advanced and specialty packaging is not simply a technical niche within Florida; it is an organizing principle that reshapes how ecosystem function. Success depends on integration across research, manufacturing, testing, workforce, and end users, and on access to shared infrastructure that smaller firms cannot build alone.

Florida’s ecosystem structure makes access central rather than optional. Shared facilities, coordinated services, and visibility into who does what, supported by partners like the University of Florida Semiconductor Institute, the semiconductor R&D power player imec, the Florida High Tech Corridor representing translational needs of most state’s research universities, the Orlando Economic Partnership, Career Source Central Florida, and many other are foundational to making the ecosystem work.

Workforce, in turn, is not a downstream outcome. It is a system constraint. Packaging and integration require technicians, engineers, and researchers who can move across institutional boundaries, reinforcing the need for coordinated workforce strategies across education levels.

What’s next for national semiconductor strategy and sense-making

In sum, this work represents one component of RTI’s broader evaluation and strategic advising support to the Florida Semiconductor Engine. The baseline and benchmarking analysis helped establish a common frame of reference, internally among Engine stakeholders and externally for national audiences. In parallel, RTI is also supporting ongoing tracking of the Engine’s fast-moving R&D and translation activities, to continue inform decision making and telling the Engine’s progress in a more technical realm of its operations.

As the Engine transitions toward its next phase, the emphasis remains on sustaining momentum while strengthening evidence-based decision-making, a balance that becomes more challenging, as investments scale and expectations rise. Looking ahead, Engine leadership is also beginning to explore how this work can extend beyond Florida, positioning the Engine within the broader Southeast and as a gateway for collaboration with Central and South American partners. This longer-term vision reflects Florida’s geographic location, industrial base, and connectivity, and is particularly relevant for advanced and specialty packaging, where distributed manufacturing, integration across borders, and access to diverse application markets are increasingly important.

For broader industry and stakeholders involved, Florida’s experience underscores a broader reality of U.S. semiconductor policy: national competitiveness will depend on how well the country understands and connects diverse regional systems, each with distinct roles and constraints.

Regional evidence does not simplify that landscape. It makes it legible. And in a moment defined by speed, complexity, and high stakes, that clarity is itself a strategic asset.

Key Takeaways

- Semiconductor strategy is regional in practice. National goals depend on how regional ecosystems align research, workforce, infrastructure, and industry capabilities.

- Evidence creates clarity amid complexity. Baseline and benchmarking analysis help policymakers and stakeholders understand regional roles, strengths, and gaps in a fast-moving environment.

- Integration matters more than scale alone. Long-term competitiveness comes from coordinated systems—shared facilities, talent pipelines, and end-user connections—not isolated investments.