It is a common and appropriate expectation that nonprofit hospitals provide for their communities in ways beyond medical care, with the expectation that their tax-exempt status supports these efforts. To this end, tax-exempt hospitals are required by the IRS to demonstrate that they benefit their communities by submitting data on dollars spent on community benefits every year. These reports tell us how much a hospital spent on a range of activities intended to increase access to health services, enhance public health, advance knowledge, or relieve or reduce the burden of government to improve health. They can also be crucial for supporting conversations and partnerships between hospitals and community organizations.

Making Community Benefits Data More Accessible

Gaining access to the data that hospitals provide about how they are supporting their communities has been challenging – until now. The data provided to the IRS exists in forms that are not easily accessed or analyzed. RTI International researchers have developed an approach to pull these data together – with other key variables – into a data set intended to support researchers and policymakers. The goal is to make community benefit data findable, accessible, interoperable and reusable (FAIR), and to display the data in a clear and approachable interface. Data and visualizations are available on the CBI website at the hospital and community levels, with tools to do comparisons on the fly. For more extensive data analyses, the data themselves can be requested and purchased in an analytic file.

Twice a year, the Community Benefits Insight (CBI) team extracts the data that hospitals across the country provide to the IRS, supplements this data with information from the Centers for Medicare and Medicaid Services and the American Hospital Association as well as U.S. Census data and makes it available for analysis through an API. The CBI data set includes community benefit expenditures reported by 501(c)(3) tax-exempt hospitals on their tax forms for the years 2010 through 2019 for all fifty states and the District of Columbia with about an 18-month lag. The other data integrated into the CBI allows for comparisons of communities in which the hospitals are located on measures like health insurance status and poverty.

How can Community Benefits Data be Used?

Community benefits data have a number of important uses. They can guide strategic allocations of resources that take into account health care, public health and other human services for a particular location. Because they are presented in a transparent and searchable way, they can increase transparency to support important dialogues at the community level. Analyses of these data can be the basis for re-aligning community health investments to address inequities and help support population health.

Data are available at the hospital level and are relevant to communities, but they can also be used to examine trends in community benefit spending at the state, regional and national levels.

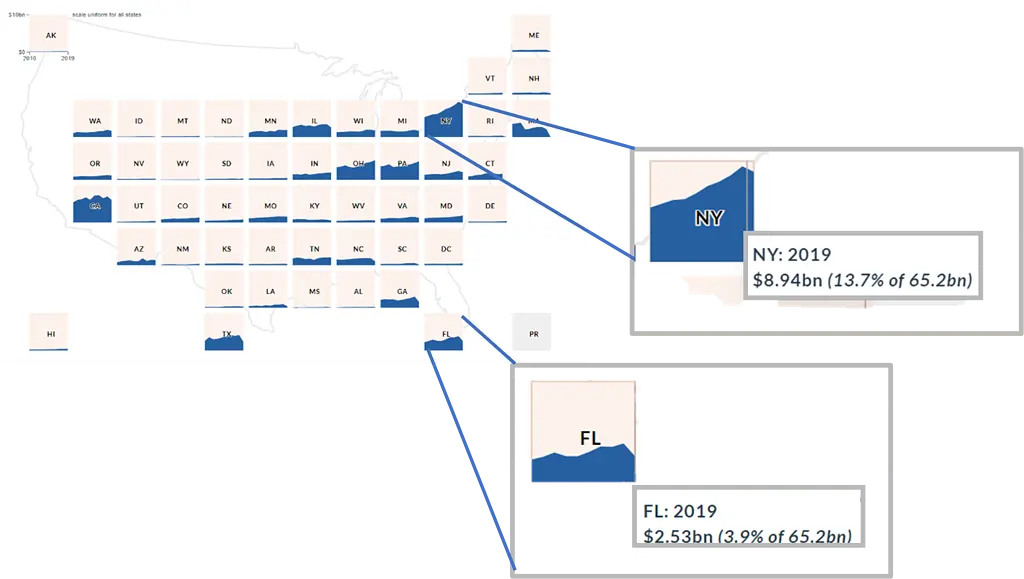

For example, a comparison of New York and Florida shows us that 15.4% of Florida hospitals report any community benefit spending, compared to 53% of New York hospitals. Despite a larger population, the community spending in Florida in 2020 was less than a third of what was spent in New York.

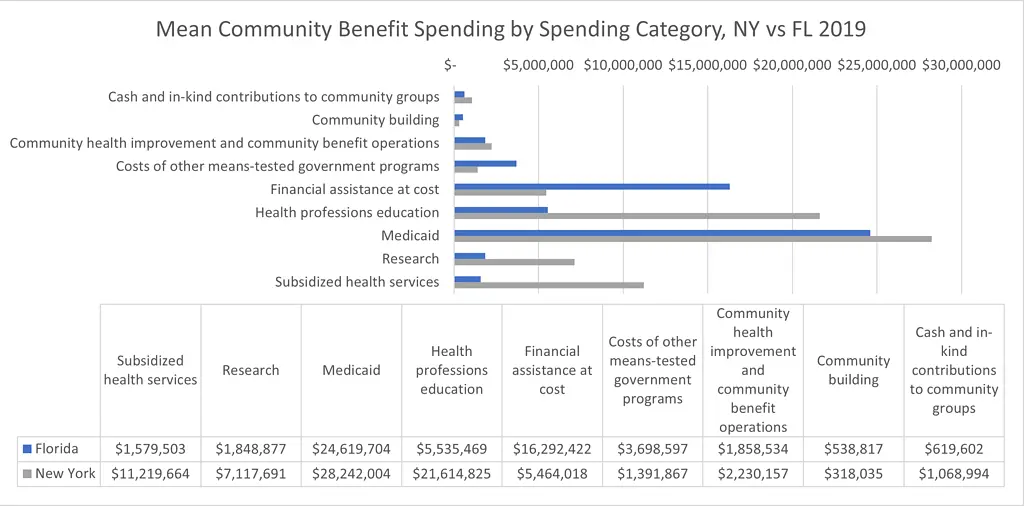

CBI data can also be used to compare spending across categories to better understand what types of services are more likely to be supported by tax-exempt hospitals.

Understanding differences in spending by community can point to variations in community needs and priorities. These data can be combined with other community-level data to understand the social determinants of health and social responsibility of hospitals. Looking at the example above we might ask questions about whether differences in populations are driving spending differences or whether there are other factors like policies or incentives at the hospital or state levels that are key drivers. These data can be used inform conversations and partnerships between tax-exempt hospitals and other stakeholders to ensure that spending is purposeful.

These are actionable data, and they are available today, along with analytic support by our data scientists and public health informaticians and epidemiologists across our Analytics and Health practice areas. In 2021, our CBI website was visited by nearly 10,000 users, which tells us there is real interest in using these data for public good. We would like for the data to continue to be used by more researchers and others, and we are here to help.

You can visit the Community Benefit Insight website for more information and to use or request the data set: Community Benefit Insight